Advocacy

Know Your Rights

As a minority shareholder, you have legal rights that protect your interests and give you a voice in how companies are governed.

Under the Companies Act 2016, you are entitled to attend, speak, and vote at general meetings; key tools to hold boards accountable and influence corporate decisions. You also have the right to timely, accurate, and reliable disclosures, including annual reports and Bursa announcements, to make informed investment decisions.

At MSWG, we ensure these rights are upheld by monitoring companies, raising concerns, and advocating for greater transparency and accountability, so that your voice is heard, and your rights are truly exercised.

Remember: your rights matter. And when you know your rights, you can help shape better companies and a stronger capital market.

Corporate Monitoring

What We Do

Corporate monitoring is at the heart of our advocacy. We closely monitor over 450 public listed companies across all 12 states in Malaysia, examining their financial performance, business operations, governance practices, and sustainability disclosures.

Our reviews are comprehensive and data-driven. Where concerns arise, we engage directly with the company either by issuing formal letters or by raising the issues during the company’s general meetings. These letters are made available exclusively to our subscribers through our Subscriber Portal.

Ahead of each general meeting, MSWG also publishes a Quick Take, a concise summary highlighting key company developments, proposed resolutions, and matters of interest to minority shareholders. Additionally, we issue our Pre-Voting Decision, which provides MSWG’s stance on each resolution tabled, guided by our published Voting Guidelines.

Advocacy

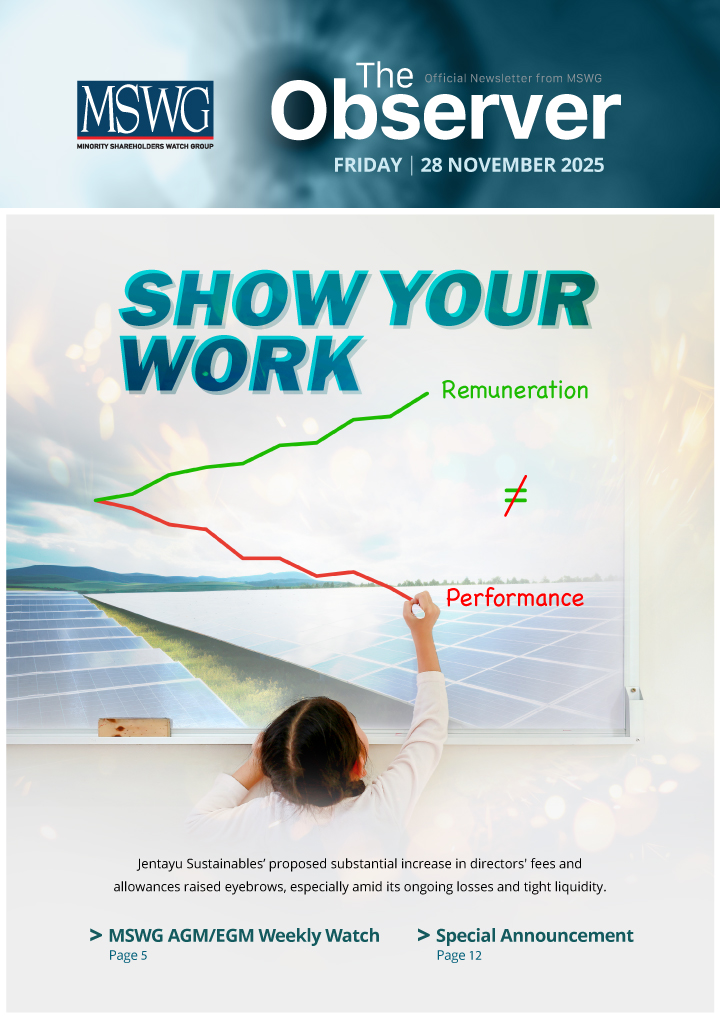

Newsletter - The Observer

The Observer is MSWG’s weekly newsletter that provides timely insights on corporate governance, shareholder rights, and sustainability developments in Malaysia’s capital market.

Each issue covers red flags from company disclosures, key highlights from general meetings, regulatory changes, and MSWG’s perspectives on emerging trends.

Clear, concise, and purposeful, The Observer is your trusted guide to staying informed and engaged in the evolving governance landscape.

The Observer Issue 20 May 2019

Advocacy

Quick Take

MSWG’s Quick Take offers a timely and concise overview of key issues relating to upcoming general meetings of public listed companies. Each Quick Take highlights material developments, corporate proposals, and resolutions that may impact shareholder rights and interests.

Prepared ahead of company meetings, Quick Takes help minority shareholders quickly grasp the context, identify potential red flags, and focus on matters requiring scrutiny, whether governance concerns, financial irregularities, or ESG implications.

Search by company name or year to explore our archive of Quick Takes.

Stock Code: 0149

Fibon Berhad

Date:

Meeting Type: AGM

Stock Code: 9997

Pensonic Holdings Berhad

Date:

Meeting Type: AGM

Stock Code: 3557

EcoFirst Consolidated Bhd

Date:

Meeting Type: AGM

Stock Code: 7083

Analabs Resources Berhad

Date:

Meeting Type: AGM

Stock Code: 7048

Atlan Holdings Berhad

Date:

Meeting Type: EGM

Advocacy

Points of Interest

MSWG raises detailed and focused questions to public listed companies on matters of concern ahead of their general meetings. These questions cover a range of issues, including board governance, financial performance, corporate strategy, sustainability commitments, and stakeholder impact.

The complete list of questions submitted by MSWG to each company is available exclusively on our Subscriber Portal.