04 May 2018

MESSAGE FROM THE CEO

Getting a new director on board

When speaking about independent directors, often two informal categories come to mind - independent directors (as the job title suggests) and the truly ‘independent’ independent directors.

This cynicism stems from the fact that majority shareholders are entitled to elect independent directors (except where companies adopt two-tier voting as advocated by the Malaysian Code of Corporate Governance (MCCG) for independent directors who have served beyond 12 years and wish to continue as independent directors).

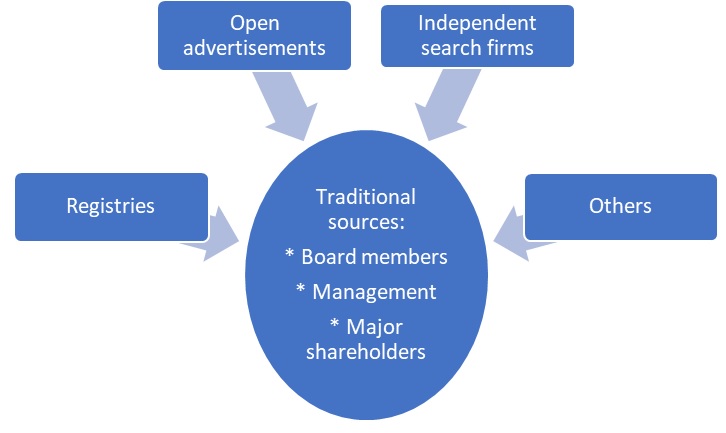

Independent directors are typically sourced from three sources, namely (i) existing board members; (ii) within the management; and (iii) among the company’s major shareholders. Obviously, this begs the question of ‘how independent’ these independent directors can really be, thus sparking a fair bit of cynicism.

The MCCG now advocates the casting of a wider net when nominating independent directors and goes on to state that reasons must be given if a board chooses not to cast a wider net.

Identifying independent directors

It is well and good to rely on the abovementioned three traditional sources in the quest to identify potential candidates, but they should no longer be the sole sources when scouting for independent directors.

As a Practice, the MCCG now states that the board must utilise independent sources to identify suitable qualified candidates. Moreover, it advocates boards to rely on a variety of approaches and sources in their search for the most suitable candidates.

In this regard, the MCCG goes on to provide three (non exhaustive) sources:

- A directors’ registry;

- Open advertisements; and

- Use of independent search firms

(The above is not an exhaustive list given some boards are known to have even leveraged LinkedIn to source for candidates).

In a further effort to preserve the boards’ honesty, the MCCG further states that listed companies should disclose in their annual reports how candidates for non-executive director positions were sourced, including whether such candidates were recommended by the existing board members, management or major shareholders.

And if the selection of the candidates was solely based on the recommendations of existing board members, the management or major shareholders, the Nominating Committee should explain why other sources were not utilised.

Nominating Committees are thus expected to cast a wider net apart from the traditional sources comprising existing board members, the management and major shareholders. And if the Nominating Committee does not cast a wider net, it should reason out – in the annual report – why the net was not cast wider.

There are a few directors’ registry around town to begin with. What pops up in mind are the 30% Club which boasts a pool of women directors with calibre and the Institute of Corporate Directors of Malaysia (ICDM).

Perhaps, the time is ripe for companies to advertise for directors just like how they advertise for other management and staff positions - after all, being a director is itself a professional job.

And finally, the MCCG alludes to the use of independent search firms or more popularly known as ‘head hunters’ - if discretion is the order of the day - in sourcing for new independent directors.

After all, an ‘independent’ independent director will be of much comfort to minority shareholders.

Regards,

Devanesan

4 May 2018

MSWG’S QUICK TAKE ON-ONGOING CORPORATE DEVELOPMENTS

LIST OF CHINA BASED COMPANIES IN FINANCIAL IRREGULARITIES OR FINANCIAL DISTRESS

|

No |

Name |

PN17 |

Share Trading Suspended |

Inability to issue latest Annual Audited Account |

Qualified / Disclaimer Opinions by Auditors |

Reported Financial Irregularities |

|---|---|---|---|---|---|---|

|

1 |

China Automoblie Parts Holdings Limited |

√ |

√ |

√ |

|

√ |

|

2 |

China Ouhua Winery Holdings Limited |

|

|

|

√ |

√ |

|

3 |

China Stationery Limited |

|

√ |

√ |

|

√ |

|

4 |

HB Global Limited |

√ |

|

|

√ |

|

|

5 |

Maxwell International Holdings Berhad |

√ |

√ (1) |

√ |

√ |

|

|

6 |

Multi Sports Holdings Ltd |

√ |

√ |

√ |

√ |

√ |

|

7 |

Xingquan International Sports Holdings Limited |

|

√ |

√ |

√ |

|

Note:

(1) In the event that Maxwell International Holdings Berhad is unable to submit the outstanding annual report, including the annual audited financial statements for financial year ended 31 December 2017 on or before 8 May 2018, the trading of the company's securities will be suspended with effect from 9.00 am, Thursday, 10 May 2018 until further notice.

[Source: Announcements on Bursa Malaysia]

MSWG’S COMMENTS:

The above table shows 7 China-based companies. They are plagued by either financial irregularities or financial distress. The most recent announcements released by some of the abovementioned China-based listed companies relate to their accounts being qualified or the issuance of disclaimer opinions by their independent auditors. Such negative publicity does not bode well for the prospects of most of the 16 China-based companies listed in Bursa Malaysia.

Shareholders are concerned about the accounting irregularities and corporate governance issues that are often brewing in the China-based companies. Most baffling is how some of these companies with hordes of cash and significant assets, like Multi Sports, Maxwell, China Automobile and China Stationery, have found their cash and assets ‘vanish’ in just a short period of time. Issues such as these raise one worrying question in the minds of minority shareholders: which will be the next China-based company to be afflicted by such issues?

The Malaysian investor community hopes to see timely stiff sanctions on such China-based companies to drive home the message that our capital market will not tolerate such wanton disregard of corporate governance and investor protection.

Perhaps it is time for our regulators to establish a task force to address this rot that is afflicting some of the China-based companies – it cannot be ‘business as usual’. There seems to be a discernible pattern and modus operandi in these afflictions.

MSWG’S AGM WEEKLY WATCH 7 – 11 MAY 2018

For this week, the following are the AGMs/EGMs of companies which are in the Minority Shareholder Watch Group’s (MSWG) watch list.

The summary of points of interest is highlighted here, while the details of the questions to the companies can be obtained via MSWG’s website at www.mswg.org.my.

|

Date & Time |

Company |

Venue |

|

08.05.18 (Tue) |

Globetronics Technology Bhd |

Hotel Equatorial Penang, Bayan Lepas, Penang |

|

08.05.18 (Tue) |

Malaysia Airport Holdings Bhd |

Sama-Sama Hotel, KLIA, Sepang |

|

10.05.18 (Thur) |

UEM Edgenta Bhd (Faber Group Bhd) |

Menara Korporat, Persada PLUS, Persimpangan Bertingkat Subang, NKVE, PJ |

|

10.05.18 (Thur) |

Gas Malaysia Bhd |

Holiday Inn Kuala Lumpur Glenmarie, Shah Alam |

|

11.05.18 (Fri) |

Malaysian Bulk Carriers Bhd |

TPC Kuala Lumpur (Kuala Lumpur Golf & Country Club Berhad), Off Jalan Bukit Kiara |

|

11.05.18 (Fri) |

Heineken Malaysia Bhd |

Connexion @ Nexus, No. 7, Jalan Kerinchi, Bangsar South City |

|

The points of interest to be raised: |

|

|---|---|

|

Company |

Points/Issues to Be Raised |

|

Globetronics Technology Bhd |

Are there any plans to increase the CAPEX budget for the financial year 2018? |

|

Malaysia Airport Holdings Bhd |

Under Note 22 on page 257 of the Annual Report, we note that RM134,747,000 of the Trade and Other Receivables have been impaired. Please provide the following information:- (a) The identity of these debtors and the amounts impaired. (b) What is being done to recover the amounts? (c) The probability of recovery of the impaired amounts. What is the Company’s policy on impairment of Trade and Other Receivables? |

|

UEM Edgenta Bhd (Faber Group Bhd) |

The Solutions Division reported a higher revenue of RM9.9 million in FY 2017 as compared to RM5.0 million in FY 2016 as reported on pages 296 and 297 of the Annual Report respectively. However, this Division recorded a higher loss before tax of RM5.3 million in FY 2017 as compared to a profit before tax of RM5,000 in FY2016.

|

|

Gas Malaysia Bhd |

It was stated in the Management Discussion & Analysis on page 44 of the Annual Report that operational risks come mainly in the form of service disruption that would hinder the Group from delivering gas to its customers as supply visibility is no longer an issue with the importation of LNG. Did the Company encounter any form of major service disruption in FY2017 and if yes, how were these issues resolved? What measures are taken to mitigate such risks? |

|

Heineken Malaysia Bhd |

We refer to page 126 of the Annual report whereat it is stated that the Group is subject to an income tax expense of RM93.1 million in FYE 2017 which translates to an effective tax rate of 25.6% and that this was higher than the effective tax rate of 22.2% in FYE 2016 and also the corporate statutory tax rate of 24%. Please explain the reasons for the increased tax rate for FYE 2017. |

MSWG’S WATCHLIST

TH HEAVY ENGINEERING BERHAD (“THHE”)

The Board of Directors of THHE announced that Messrs. Deloitte PLT ("Deloitte"), the company’s Independent Auditors, had expressed a disclaimer of opinion in the Company’s Audited Financial Statements for the financial year ended 31 December 2017 that it is unable to ascertain the ability of the group and of the company to achieve sustainable and viable operations to generate adequate cash flows from their operating activities and the timely and successful formulation and implementation of the entire proposed regularisation plan

[Source: THHE’s announcement on Bursa Malaysia’s website on 27 April 2018]

LOCAL NEWS AND DEVELOPMENTS

Property retail segment consolidates

https://www.thestar.com.my/business/business-news/2018/04/30/property-retail-segment-consolidates/

Malaysian labour force up 2% to nearly 15m in 2017

http://www.theedgemarkets.com/article/malaysian-labour-force-2-nearly-15m-2017

Retail sector to improve post-GE14

http://www.theedgemarkets.com/article/retail-sector-improve-postge14

Bank Negara adds IPG Capital, Spot Gold Scheme to alert list

Malaysian palm oil price hits over one-week low ahead of industry data

Intraday short selling measures claims first victim – Unisem

Malaysia should look beyond ringgit to draw Chinese to sukuk market

UMW extends offer for MBM Resources, Perodua till end-October

http://www.thesundaily.my/news/2018/04/29/umw-extends-offer-mbm-resources-perodua-till-end-october

The AOB Sanctions Auditor for Poor Quality Audit Work

https://www.sc.com.my/post_archive/the-aob-sanctions-auditor-for-poor-quality-audit-work/

China Ouhua falls 6.67% on external auditor's qualified opinion

http://www.theedgemarkets.com/article/china-ouhua-falls-667-external-auditors-qualified-opinion

Maxwell active, falls 25% on missing deadline to release Annual Report

http://www.theedgemarkets.com/article/maxwell-active-falls-25-missing-deadline-release-annual-report

No truth in report of stake sale to foreign parties — FGV

http://www.theedgemarkets.com/article/no-truth-report-stake-sale-foreign-parties-—-fgv

GLOBAL NEWS AND DEVELOPMENTS

Weak consumer spending seen restraining US growth in 1Q

http://www.theedgemarkets.com/article/weak-consumer-spending-seen-restraining-us-growth-1q

China's April manufacturing growth seen ebbing slightly, trade war a risk

China eases restrictions on foreign ownership of securities ventures

Oil slips after US rig count rises, Iran concerns cap downside

https://www.malaymail.com/s/1625602/oil-slips-after-us-rig-count-rises-iran-concerns-cap-downside

UK growth falls to five-year low, Bank of England seen delaying rate hike

Germany lowers growth forecast, but will still be highest in 7 years

Russia pauses rate cuts after U.S. sanctions spur inflation risks

Low inflation extends era of negative rates in Sweden

US considers tightening grip on China ties to Corporate America

http://www.theedgemarkets.com/article/us-considers-tightening-grip-china-ties-corporate-america

India's Modi gets museum tour with Xi as China trip begins

http://www.theedgemarkets.com/article/indias-modi-gets-museum-tour-xi-china-trip-begins

Why India's fuel prices are sky-high when oil isn't

https://www.malaymail.com/s/1625565/why-indias-fuel-prices-are-sky-high-when-oil-isnt

ECB keeps massive stimulus in place as trade headwinds rise

https://www.malaymail.com/s/1624578/ecb-keeps-massive-stimulus-in-place-as-trade-headwinds-rise

BOJ removes timeframe for price goal, keeps policy steady

https://www.malaymail.com/s/1624750/boj-removes-timeframe-for-price-goal-keeps-policy-steady

MSWG Analysts

Lya Rahman, General Manager, [email protected]

Rebecca Yap, Head, Corporate Monitoring, [email protected]

Quah Ban Aik, Head, Corporate Monitoring, [email protected]

Norhisam Sidek, Manager, Corporate Monitoring, [email protected]

Wong Kin Wing, Manager, Corporate Monitoring, [email protected]

Hoo Ley Beng, Manager, Corporate Monitoring, [email protected]

Elaine Choo, Manager, Corporate Monitoring, [email protected]

Lee Chee Meng, Manager, Corporate Monitoring, [email protected]

Abdul Halim Alias, Manager, Corporate Monitoring, [email protected]

Mustaqim Yusof, Analyst, Corporate Services, [email protected]

Muhammad Faris bin Mohamed Yusof, Analyst, Corporate Monitoring [email protected]

DISCLOSURE OF INTERESTS

• With regard to the companies mentioned, MSWG holds a minimum number of shares in all these companies covered in this newsletter save for China Automobile Parts Holdings Limited, China Ouhua Winery Holdings Limited, China Stationery Limited, HB Global Limited and Maxwell International Holdings Berhad.

Feedback

We welcome your feedback on our newsletter and our work. Email us at [email protected] with your comments and suggestions.

DISCLAIMER

This newsletter and the contents thereof and all rights relating thereto including all copyright is owned by the Badan Pengawas Pemegang Saham Minoriti Berhad, also known as the Minority Shareholder Watch Group (MSWG).

The contents and the opinions expressed in this newsletter are based on information in the public domain and are intended to provide the user with general information and for reference only. Best efforts have been made to ensure that the information contained in this newsletter is accurate and current as at the date of publication. However, MSWG makes no express or implied warranty as to the accuracy or completeness of any such information and opinions contained in this newsletter. No information in this newsletter is intended to be or should be construed as a recommendation to buy or sell or an invitation to subscribe for any, of the subject securities, related investments or other financial instruments thereof.

MSWG must be acknowledged for any part of this newsletter which is reproduced.

MSWG bears no responsibility or liability for any reliance on any information or comments appearing herein or for reproduction of the same by third parties. All readers or investors are advised to obtain legal or other professional advice before taking any action based on this newsletter.